News, Insight and Opinions

Invasion of the Institutional Housing Snatchers!

- 012926

- 2 minutes

In recent years, the U.S. housing market has seen a significant influx of institutional investors, raising questions about the long-term effects on housing availability for average Americans. Spoiler alert: these pod people may not be the monsters they seem.…

Notes From the Middle of a Government Shutdown

- 103025

- 2 minutes

The government has shut down 20 times in the last 50 years. Although the S&P 500 has stayed relatively calm during these periods, the mean duration has been about 8 days— which this year’s shutdown has already more than tripled. But it goes deeper.…

Tales From the Passive Investor Loop

- 082825

- 3 minutes

Since overtaking active funds in 2023, passive funds have continued to grow in popularity. Does a market dominated by passive investors perform differently? Economists are noticing some curious behaviors emerging.…

What To Do With a Freediving Dollar?

- 072525

- 3 minutes

This year has proved rough waters for the USD. Growing skepticism from international investors has had its effect, drastically lowering the dollar’s value. But a weak dollar isn’t all bad. How might investors benefit from a situation like this?…

Tariffs, Immigration and Crypto (Oh My?)

- 011325

- 2 minutes

The first quarter of the 21st century was a wild ride. With (likely) more surprises ahead, how will the market fare under the new administration's policies? And how can we hold steady as she goes? One thing's for sure: Expectation doesn't always match reality.…

From the Desk: Will the Santa Claus Rally Continue? Vol. 2

- 120524

- 2 minutes

…

Mind Games: The Negativity Gap

- 040124

- 4 minutes

Macroeconomic data shows a remarkably healthy US economy—but survey says the average American isn't feeling it. So why the disconnect?…

From the Desk: Will the Santa Claus Rally Continue?

- 122023

- 2 minutes

At the time of this post, the S&P 500 is up 3.85% this month alone. The Cleveland Browns are 2-1 over the same period. Clearly, the Santa Claus rally is benefiting both investors and Browns fans alike. The question is, will it continue?…

When Bulls Win—And Other Tales of Monopoly

- 112023

- 4 minutes

Just seven tech stocks drove 70% of the S&P 500’s gains in the first two quarters of this year. Now, the US Dept of Justice is fighting a landmark case against one of those seven. What might this portend for Google, other big-tech players, the market, and you?…

From the Desk of Joe: A Fourth Quarter Gameplan

- 110323

- 3 minutes

I'm a lifelong, diehard fan of the Cleveland Browns. I'm also a five-year fan of Fed Chair Jerome Powell. Given Sunday's Browns game and their debacle of the fourth quarter, I can't help but consider some similarities between these two relationships.…

The AI Cooperative

- 080723

- 5 minutes

The possibilities for artificial intelligence in the financial sector are thrilling—and concerning. What can history teach us about the dangers of letting the latest tech innovations loose on the stock market?…

The Economy of Indulgence

- 051223

- 3 minutes

Drastic measures taken during the 2008 financial crisis were largely successful—but we’re still grappling with unforeseen repercussions. How did we get here? And how do we protect ourselves as investors?…

A Day in the Life at the Fed

- 030223

- 6 minutes

Inflation and recession might qualify as incendiary language when abused by ratings-hungry media bigmouths. Join us for a fictional day in the life at the Fed and find reason to push fear aside and take a colorful ride.…

Is It a Wonderful Life?

- 120922

- 4 minutes

As investors, maintaining perspective can be tough when life hits us with a daily poop emoji. With a bit of consideration, these three topics can help turn our internal frown upside-down: Trust, relativity and tolerance—in brief.…

Was the Plan To Get Punched in the Mouth?

- 060622

- 3 minutes

April's Consumer Price Index (CPI) 12-month projection of 8.3% is a step in the right direction, but we continue to see the highest rates in nearly 40 years. Is this just post-pandemic fallout, or are there other forces at work here?…

War—What is it Good For?

- 022322

- 3 minutes

The U.S. market is indelibly tied to the country's involvement in global affairs—so as things threaten to boil over in Ukraine, should we prepare our wallets for the worst?…

I Like My Market Corrections Sunny Side Up. You?

- 100821

- 3 minutes

Is an impending market correction the interstellar monster we might imagine it to be? It all depends on how you serve it. Order up!…

The Zen Investor's Bliss

- 081721

- 3 minutes

Two paths diverged in a wood, and I, as an investor, logically took the one with the sign that read: "Toll-Free Road to Zen-Like Investing."…

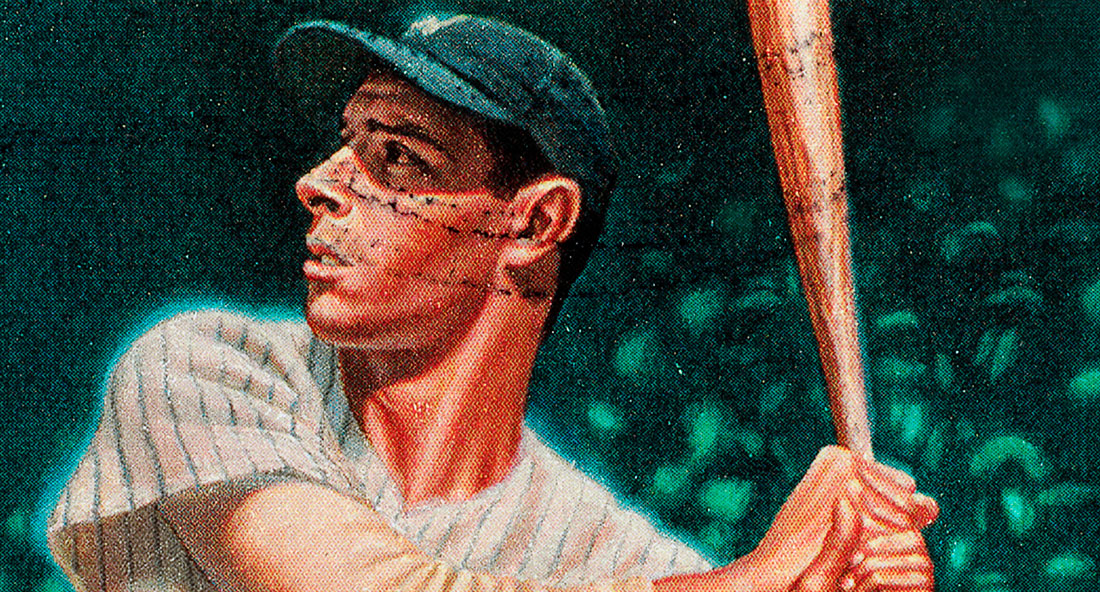

Those D@#% Yankees

- 070121

- 3 minutes

The story of the 1941 New York Yankees provides a lesson on how to keep yourself in check when the stakes are high and the ship appears to be sinking. Part II of our series underscores the value of taming emotion when there's volatility about.…

Becoming Khan

- 040721

- 3 minutes

It’s nothing new—the market runs on emotion. But how can we avoid doing the same? Spoiler alert: It IS all in your head.…

Bear Markets Come and Go

- 032420

- 1 minute

Don't lose sleep over market volatility. There have been 10 bear markets since 1950, and the market has eventually recovered every time.…

Does Inversion = Recession? Does it Matter?

- 122718

- 2 minutes

Are we in a recession? Are we heading for a recession? Should we go to cash because of the recession? Let's clear this up.…

Will the Holiday Shopping Season be Enough to Stop the Markets from Falling and Turn the Momentum?

- 112818

- 1 minute

Will this holiday shopping season be enough to beat the bear? Early data suggests that may very well be the case.…

Can Tax-loss Harvesting Help You Save on Taxes?

- 112118

- 1 minute

How do you harvest losses, and could it save you money? Here are a few things to consider.…

What Do These Big Drops in the Market Mean for You?

- 102618

- 1 minute

The last few weeks or so have been a little unsettling for many investors. How worried should you be?…

Will This Win Streak be SNAPped?

- 032117

- 2 minutes

Just how unusual have the last few months in the market really been? We dug up some statistics to give perspective.…

Brexit Backwash

- 062416

- 1 minute

The UK has voted to remove itself from the European Union. How we react to events like this are what differentiate traders from investors.…

Complexity, Simplified: Inter-sowing Seeds of Financial Wisdom

- 102815

- 5 minutes

Wisdom can be universal--from farming to financial investments. So when working for growth in fluctuating markets, amend your soil with expert advice.…

Anticipating the Fed

- 102715

- 2 minutes

Will the Fed raise rates? Should they? And what happens to the market if they do or don’t?…

Memo

- 082615

- 1 minute

As we continue to live through the increased volatility in the financial markets, it’s a natural reaction to question how this may impact our own individual wealth.…

Risk vs Reward

- 021515

- 3 minutes

The S&P 500 saw huge returns in 2014, but most portfolios didn t echo those gains. Would the investment risk have been worth the reward?…

Retirement Essentials

- 111214

- 6 minutes

Your retirement planning Holy Grail: To determine an ideal withdrawal rate. But with inflation and myriad variables, you may need a guiding light.…

Recent Equity Market Volatility

- 101614

- 2 minutes

Here at FNA, we have been anticipating a pullback in the markets for the last two quarters. Now that we are living it, I would like to answer a pair of questions that are likely on many of your minds.…