Is It a Wonderful Life?

- 120922

- 4 minutes

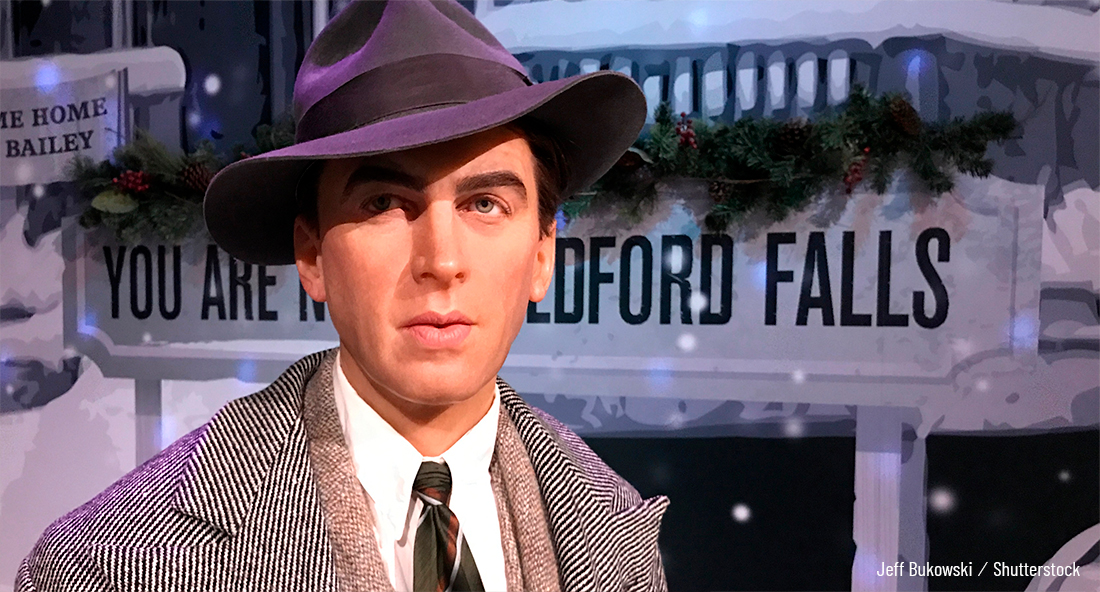

Christmas Eve 1945, Bedford Falls, New York: The otherwise selfless George Bailey is having suicidal thoughts. Life’s bearing down hard on a good man in ways that take a Dickensian supernatural intersect to remind him that his life was, in fact, mostly wonderful. Thank you, “Mr.” Odbody, for the save. And by the way, Clarence, gimme some of that.

One option for a 2022 year-end holiday greeting card for our intrepid clients and readers: Glittery front cover reads “Happy Holidays!”; message inside is simple but candid: “George Bailey got nothing on you.” No glitter here. Just the facts. Some of us have had a rough year.

Instead of a card, we send an 885-word (less-than-angelic) note of encouragement. Take heart: you’re already at 124.

As George Bailey learned, maintaining perspective is tough when life hits you with a daily poop emoji. But as we learn in time with texting, context needs inferring, and so much depends on measured replies. Moreover, in this case, it’s important not to miss that that poop graphic is smiling. :)

Beyond that, we submit three topics that, with a bit of consideration, can help us turn our internal frown upside-down when our investor life is raining scat: Trust, relativity, and tolerance. In brief.

Trust

Or, as Merriam-Webster (MW) explains, the “assured reliance on the character, ability, strength, or truth of someone or something.”

Our story begins at Ohio’s world-famous Cedar Point, offering an astounding array of notorious coasters. Braving one requires several degrees of trust. As we’re crawling our way along the 120-minute wait for a 180-second dose of fear-induced pleasure, our brain quietly reinforces our trust circuits, reassuring us that we have reason to trust the engineers, builders and operators of the rocket train we’re about to mount and ride into the clouds—with our hands in the air and without a helmet, no less. Now that is trust.

The market is its own brand of coaster. And hopping on that crazy train requires trust. Sometimes it’s more like that old-school wood-frame coaster. You know, the one that dispenses with the comforts of these modern wimped-out tubular deals and tries the tensile fortitude of your connective tissue.

For this ride, we need to trust the very nature of the market itself, its historical data, and (drum roll) our advisor. Looking back at MW’s definition, we can understand why that’s important. And why it’s vital to an investor’s composure. Much like the Point’s wood-frame Mean Streak (1991-2016), a rough market can expose the true grit of our trust. One's sinew hurts just writing about it.

Relativity

The purely hypothetical-and-bearing-no-resemblance-to-anyone-we-know Greta checks her portfolio and sees that in the last week, she’s lost over $70k. Her thought-emotion-response signals occur in milliseconds and go something like this: Thought: “what the—?”. Emotion: fear. Physical response: sinus tachycardia (i.e., palpitations, chest pain, fainting, lightheadedness, rapid pulse rate, shortness of breath). Proposed remedy? Our financial theory of relativity.

She may have lost 70k in a week, which is a blow and terrible news. But if she looks closer at her portfolio’s performance over the past few years after a whiff or two of smelling salts, she’ll be reminded that the 70k was a loss on a 150k gain. Her initial spend of 300k has earned her 80k to date. Not too shab. So it’s a relative matter; in percentages, she’s still performing well at just under +27%.

Now while any similarity between Greta and an actual human is simply coincidental, she’s a helpful archetype. And her example dovetails with our last area of concern.

Tolerance

This one can be tricky. It helps if we can face down three known versions of our personal reality: The person we believe we are, the person we present to others, and the person we really are. As an investor, it comes down to the reality of our risk tolerance. This, in turn, bears on how we react to a struggling market and our ability to accept the highs and lows of how it is known to perform.

For example, some of us have a fiscal thorn in our bottom from past mistakes and are essentially risk averse. If we own that, we tend to swim in modest depths and may find it easier to mitigate the emotional side of loss.

Regardless of circumstance, we must be skilled at managing both loss and gain. We can’t be expert investors and novice losers at the same time. Therefore, we admonish, “investor, know thyself.” Please.

We’re willing to concede that high on the list of folks who get a pass on cockeyed optimism are the undefeated 1972 Miami Dolphins. And we can pardon the extra hurt of the 2007 New England Patriots Super Bowl loss. No theory of anything could work on that hit, ever. To be honest, we’re not sure if George Bailey could have survived it. Indeed, Clarence Odbody would have been caught in a chain reaction of unimaginable regret and joined George in his desperate plunge. Tragic, for sure. Of course, now we have to imagine Jimmy Stewart in the role of pro quarterback. It’s too much to ask.*

Thankfully, we’re no doubt neither Fin nor Pat in the world of investing. So, no excuses. ;) If we can enhance our trust, embrace the relativity of loss, and discover our true risk tolerance, we might find that with all its highs and lows, we truly have what is, in fact, a wonderful life.

* At Mercersburg Academy prep school and to his disappointment, a young Jimmy Stewart was relegated to the third-tier football team due to his slender physique [ouch]. —Wikipedia, James Stewart: Early Life. Eliot, Mark (2006). Jimmy Stewart: A Biography. New York: Random House. ISBN 9781400052226.

The views and opinions expressed herein are those of the author(s) noted and may or may not represent the views of Beacon Advisory or Lincoln Investment. The material presented is provided for informational purposes only. When you link to any of these websites provided here, you are leaving this site. We make no representation as to the completeness or accuracy of information provided at these sites. Nor are we liable for any direct or indirect technical or system issues or consequences arising out of your access to or use of these third-party sites. When you access one of these sites, you assume total responsibility for your use of the sites you are visiting.