Those D@#% Yankees

- 070121

- 3 minutes

Present market conditions are some that test our ability to keep emotions in check. Part I of this series speaks to that skill in colorful terms, so ICYMI, check it out after reading this (Trekkies beware). Part II looks at how data and objectives can help tame emotion when there's volatility about.

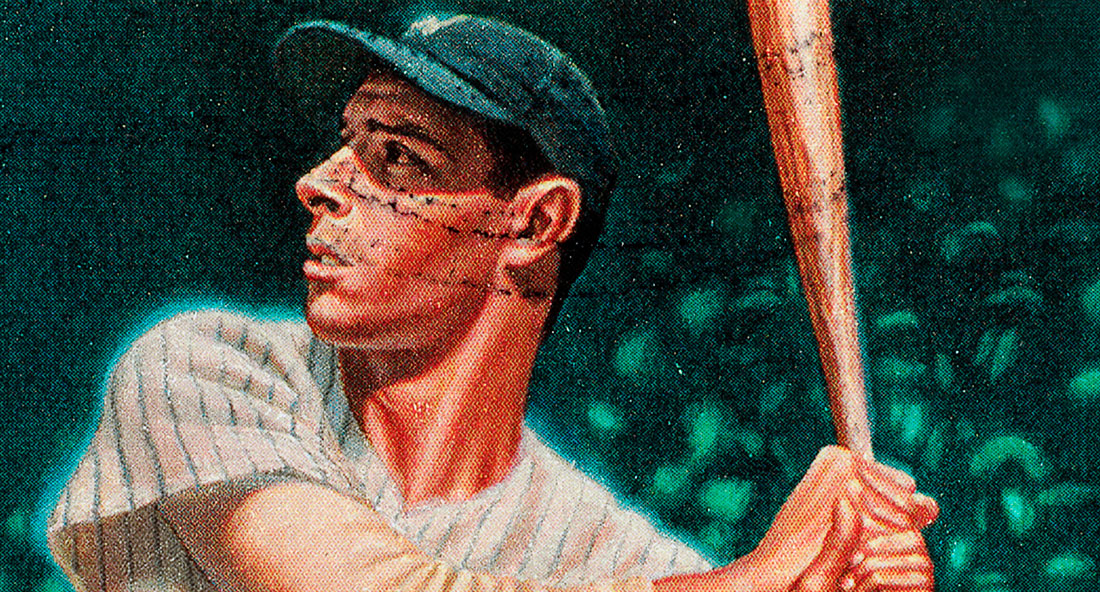

It was the best of times and worst of times for the 1941 Yankees. Joe DiMaggio had established himself as their star player, but the long '41 season got off to a rocky start—for the team as a whole, but especially for DiMaggio. It was a high-stakes period for them as The Yankee Clipper looked like he was about to sink. What helped management maintain a disciplined outlook and turn out an exceptional year? Data and objectives (D&O).

Like the '41 Yankees leadership, a good adviser will have acquired the discipline to see through the 'noise' of volatile market conditions and, importantly, perceive those about to emerge. That's why we need the pros. Still, this is where a little quiet eye is invaluable for all of us.

Some of that 'noise' comes from a 24-hour news cycle with its own agenda: How about proffering a mouthful of muddled speculation that rivets viewers' anxious minds to a gallery of rouge-dusted pundits? Pays the bills, lines the pockets. Our job is to be wary of profit-driven opinion and perhaps skeptical in any case. Otherwise, we risk acting on the wrong kind of energy.

That's where a little D&O goes a long way. They help center us on more rational pathways by empowering reason. When it comes to building and preserving wealth, reason is a powerful ally. And that 'follow your heart' thing is a fool's axiom. It was ultimately reason that helped the '41 Yankees stay the course.

Admittedly, it's challenging to detect whether we're acting more on emotion than rational thought. Partly because our heart happens to be good at fabricating compelling grounds: Like, "look, I earned that 1000 calorie slice of pie (by working out and 'burning' 137)." Or, "this toupee looks awesome with my ponytail (said Mr. Boone just before being attacked by the raccoon on his head)." We've all been there.

For most of us, though, the emotional and rational intersect is hazy, at best. That fog can be a liability, especially when the stakes are higher. So let's review how data and objectives can offset that deficiency.

First, how can clear objectives help? For one, by sustaining perspective—helping us see through the noise by keeping our focus on the end game. This helps protect us from nearsighted information feeds that do little to help us make prudent decisions. Our goals remind us that this is an endurance race, not a sprint, and therefore realign our breathing, pace, and form to that run. It's not to say we shouldn't pivot at times. But those turns should be tight to objectives and rational.

Next up: how can data help? While it's not a tonic, it can arm us with more heart-neutralizing power and train us to avoid trusting our gut, especially if said gut is being dosed with putrid narratives. And while intuition can be a terrific utility, it's not what we want our neurosurgeon relying on as she drills into our cerebrum. Something more objective, please!

Let's illustrate the need to bring data to bear on our real-time reaction to market fluctuations. Like when we arise on a blustery day to news bleating from our clock radio on the topic of tax reform that gets us looking for reasons to buy or sell. How's our rational/emotional intersect doing? Do we detect any nervous energy? Can we identify how fear is operating?

Before anxiety takes hold, we recall a recent FNA market update (plug) that dropped some knowledge about this very thing. Namely: volatility around tax hikes has historically been short-lived. According to JP Morgan, capital gain tax-rate increases in 1987 and 1993 caused only modest intra-month volatility and saw less than 5% losses.* Such insight helps quiet the noise and steady our hand.

It was D&O that helped the '41 Yankees maintain an even keel. When DiMaggio's customarily impressive batting average tanked 200 points in less than a month, and with no ready signs of recovery, they worked the long game, focusing on stats from DiMaggio's last four years' solid performance. On May 15th, he unceremoniously began his record 56-game hitting streak, and the Yankees went on to take yet another World Series title—their fourth of nine titles they'd claim during DiMaggio's 13 seasons.

Respect. Doesn't mean we have to love New York. But we get the point. There's no room in the work of building and preserving wealth for untamed hearts. Our call to action is simple: Get your D&O in order and remember The Yankee Clipper. Then, we be like: Go Indians! (Until further notice.)

* Past performance is not a guarantee of future results.